Zero-Sum School Funding

As Texas considers private school vouchers, school finance guru Paul Colbert explains how a decade of "revenue swaps" has short-changed public schools

Former State Representative Paul Colbert’s public testimony on HB 2 is a plain-language explanation of how public school funding in Texas has been falling behind for more than a decade. Using publicly available data from the Texas Education Agency, Colbert demonstrates that there has not been a true increase in funding to property tax-supported school districts from state revenue sources since 2011. Instead, legislators have required school districts to reduce property taxes, and then swapped in state funds to replace the funds school districts have lost through property tax cuts. Colbert concludes that all of the “increase” in funding in general and funding per student for traditional ISDs has come from local property tax revenue increases, at least going back to 2011.

As plain spoken as Colbert is, this is dense material, and it can be hard to follow, especially if you don’t have the data right in front of you. We’ve provided two visual aids: first, the slides Colbert is referring to in his testimony, and second, a transcript of his testimony including discussion with members of the committee.

The slides are pasted into the bottom of this post, or you can download them here.

TRANSCRIPT

Paul Colbert:

Thank you Mr. Chairman and members. My name is Paul Colbert. I'm here just speaking on behalf of myself today. For those of you who don't know me, I served on this committee for many years. I was the Budget Chair of Education for eight years when I was in the House. In the two minutes that I have to comment on 140 page bill I'll just try to hit a couple of key points.

Number one you had, I would like to thank first of all Chairman Buckley for doing a tremendous job of really trying to address all the various needs of the various different types of students that we have within the State of Texas, and increasing the compensatory education weight is a step in that direction, although it's a very small step in that direction. We regularly hear about the funding gap, however, between both economically disadvantaged kids and English language learners, and there is no comparable increase for bilingual education weights, or the dual language weights, and so I would recommend that you include that same 0.005 increase at least into the bill when you come out with your committee substitute.

The other thing I'm going to talk about, and I'll do it real, real briefly, you've got a big handout here from me, and this is similar to material that I went through with y'all and with the Budget Committee two years ago. This is basically how much money actually goes from the state, from state revenue sources, to traditional property tax supported ISDs year by year by year. And what you'll see from this is that basically it has remained pretty much flat, that there has not been an increase in the amount of money that we give to ISDs from state revenue sources, other than the degree to which we have given them money as revenue swaps for the amount of tax relief that we have required them to perform. I'll walk you through these numbers if anyone has any questions about them, but what it means is that all of the increase in funding in general and funding per student and traditional ISDs has come from local property tax revenue increases, at least going back to 2011. Thank you for your time.

Chairman Buckley:

Thank you for your testimony. Members, any questions for these witnesses.

Rep. John Bryant:

Mr. Chairman?

Chairman Buckley:

Yes, Representative Bryant?

Rep. John Bryant:

Mr. Colbert, these are numbers that you passed out, I think, to all of us, last session I asked you for data on how much funding our traditional school districts, by that I mean the independent ISDs, actually have received from the state over the past 12 years. Is this the same data?

Paul Colbert:

Well, it's the same data but updated for the two years that have occurred since then.

Rep. John Bryant:

And would you tell me, tell the committee, where these came from?

Paul Colbert:

All of the data that's here comes from one of two sources, either the Texas Education Agency Statewide Summary of Finances for each individual year, or the Texas Education Agency Statewide Summary of Charter Schools. Because in order to be able to get at what is the money that goes to the traditional property tax-supported ISDs you basically have to subtract the charter school money out of the total amount of revenue that they're otherwise given. And I can walk you through the columns on this to explain how you get to those numbers.

Rep. John Bryant:

Please do.

Paul Colbert:

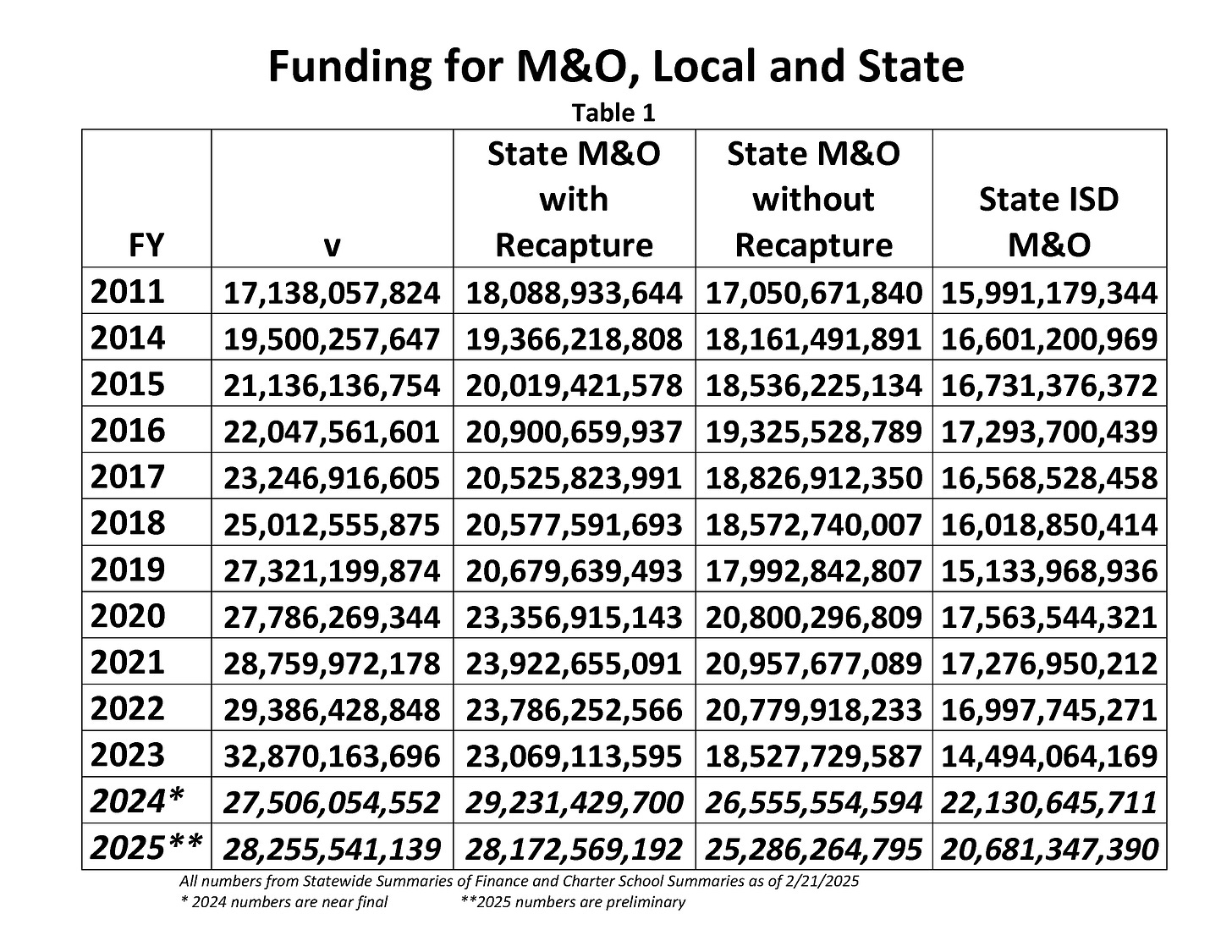

Okay. If you look at Page 1 here of the handout, you've got the fiscal year, and of course the fiscal year is the second year of the school year. So 2011 is the 2010/2011 school year. I didn't include 2012 and 2013 because those were the two years where we cut dramatically large amounts of money out of school finance and so they're anomalies rather than years worth looking at. But basically from 2011 to 2025, which would be the '24/'25 school year would be the years we're talking about. The first column is their local M&O revenue. And again, this is from the TEA's Statewide Summary of Finance. The second column shows what that same Summary of Finances shows are the amounts of revenue given to the school districts for M&O purposes.

However, that money includes within it the money that the state receives and then redistributes for recapture. And that money is local property tax money, it's not from state revenue sources and it's already in the first column. So if you were to add the two columns together you'd be double counting the amount of money that is recapture money. So you've got to take that money out to get what comes from state revenue sources rather than local property taxes. And that's what the next column is. That's the state M&O without recapture. But again, that doesn't tell you what goes on in your property tax-supported school districts because that also includes the money that goes to charter schools. Now, charter schools don't get any local M&O revenue, they're 100% funded by the state. So the final column on this shows you how much money goes to the districts that people tend to think of as their local school district, their local property tax-supported school district.

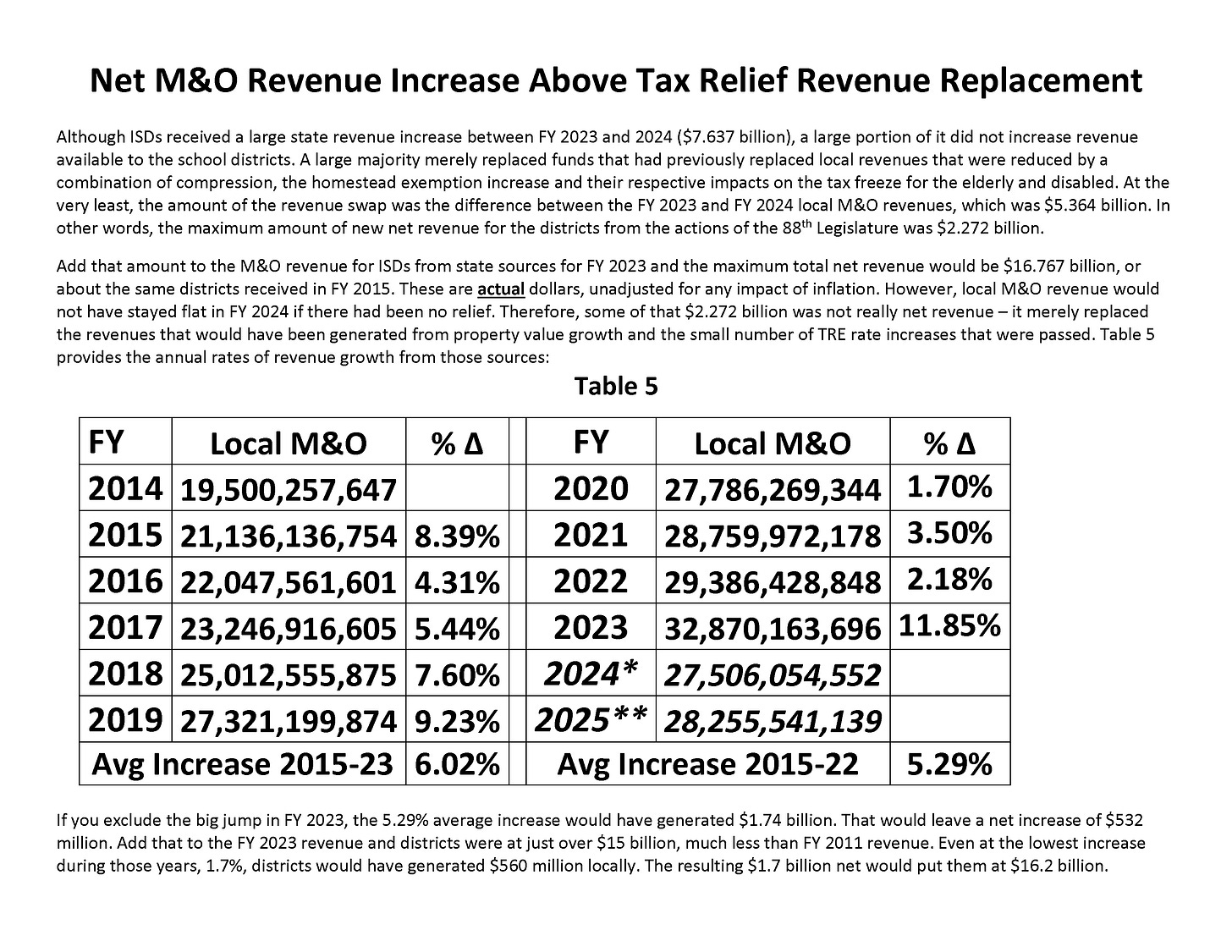

This is how much money they actually got after you take out the recapture money that is not state revenue, and the money that didn't go to them but went to the charter schools. This is how much state revenue went to them each year from 2011 forward, other than the two years that I mentioned. And basically, as you can see, it's hovered somewhere in the 16 to $17 billion range. Hasn't really gone up, hasn't really gone down a whole lot until right near the end it went down a bunch. But a little bit of that is an overstatement because starting with fiscal year 2020 we started doing some replacement of local revenues because we required districts to compress money down. Actually starting in 2016 we increased the Homestead Exemption, so there was a little bit of money then, but then we got into big time costs starting with fiscal year 2020.

So all of the numbers after that really overstate the case, because not all of that was net revenue to the school districts. It was just replacement for money that they could no longer collect because of the required either tax compression or the increases in the Homestead Exemption.

Rep. John Bryant:

But what's the conclusion from looking at that column? It appears, and I believe I was based on this data saying this in the last session, that traditional independent skill districts have not had an increase in dollar amount, leading up to the question.

Paul Colbert:

First of all, let me repeat, these are actual dollars. These are not adjusted for inflation. This is before the impact of inflation. And so when we looked at these numbers two years ago, you can see from the fiscal year 2023 the amount of money that went to the ISDs was actually less than $14.5 billion. That was $1.5 billion short of the amount that we gave those same school districts in 2011, and there were more students in 2023 than there were in 2011. So not only did we not cover the total cost of those increase in students, but we were actually giving $1.5 billion less from state revenue sources to traditional ISDs in 2023 than we were in 2011, 2014/15, and any of the other years.

Rep. John Bryant:

So it's fair to say then that for 10 years our traditional ISDs did not have an increase in state funding.

Paul Colbert:

In funding from state sources. Basically what the state did when it did increase funding was it took the savings that the state realizes because property values go up. When your property values go up the state's responsibility under the foundation school program goes down. So all the state did was recycle their savings from the property tax value increases and recycle that into the foundation school program. And that's why the numbers remained relatively flat.

Rep. John Bryant:

I'm just trying to tease this out, the plain statement, and I want you to tell me if I'm wrong, that our independent skill districts have not had an increase in funding from the state for more than 10 years.

Paul Colbert:

From state revenue sources. The amount of money from state tax sources, state fees, whatever sources go into the general revenue fund that are transferred into the foundation school fund, they did not have an increase up until 2024. And we can talk about 2024 in a moment, it's some pages farther on. Because, again, you had a very large amount of tax relief. And so a lot of that increase you see from 2023 to 2024 is tax swap money. And we can talk about that.

Rep. John Bryant:

When I say state and you say state sources, what's the difference?

Paul Colbert:

Well, the difference, again, is that the state basically took the money that they got from lowering the value of how much the state would otherwise pay on education because property values went up, and then put that back into the system. So, again, if you look-

Rep. John Bryant:

Let me ask it another way. Whatever the system is-

Paul Colbert:

When we get to the revenue per ADA column, table, I mean, which is table number three, it will become a lot more clear. We are not putting additional revenue from state revenue sources. We are merely saying, okay, the cost of the foundation school program would otherwise have gone down, so we'll keep it constant in terms of what the state puts in from state revenue sources.

Representative Frank, you seem incredulous, and I'd be glad to answer any question you might have with respect to it.

Rep. John Bryant:

Yeah, well, I won't keep trying. I mean it's still astonishing to me that we got more in 2011 than we got in 2023.

Paul Colbert:

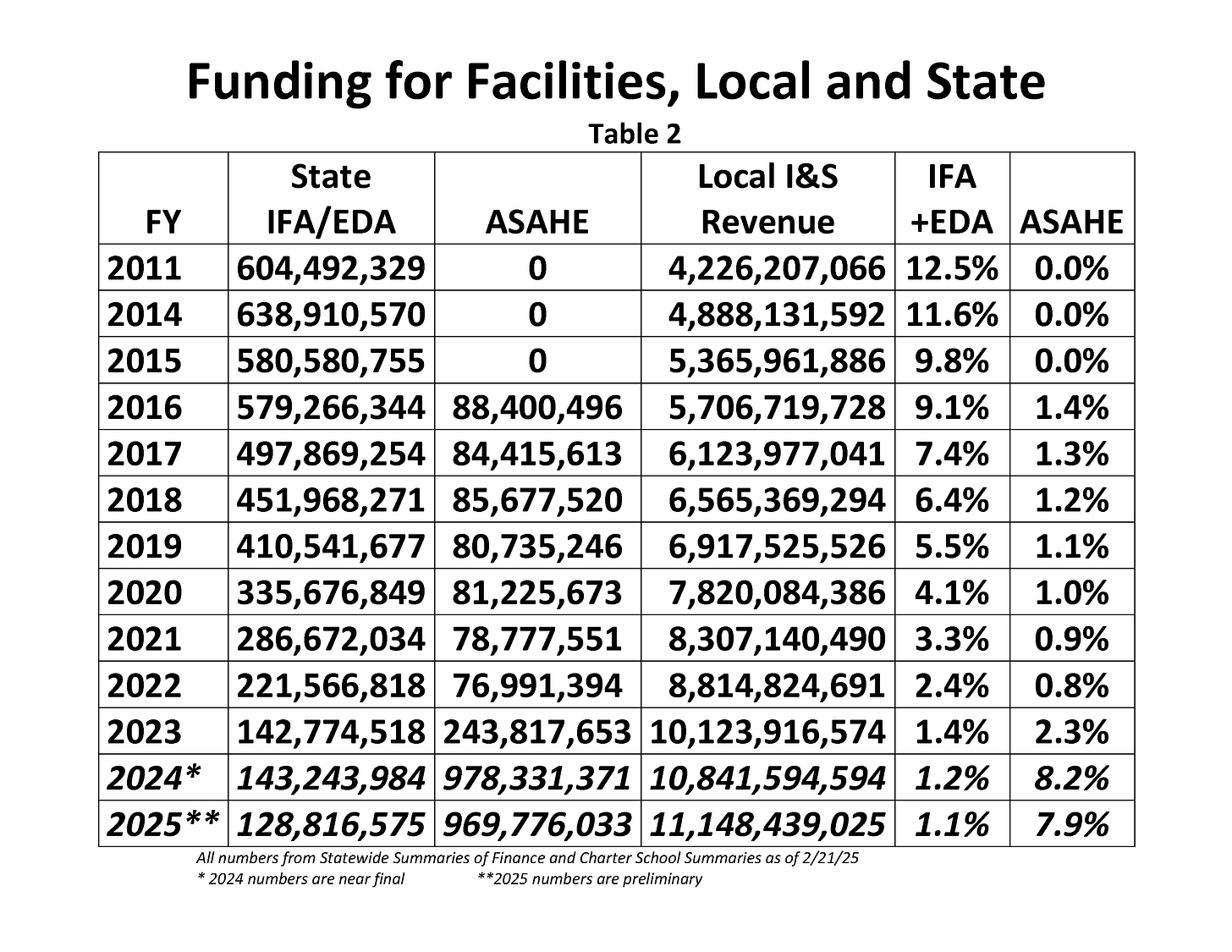

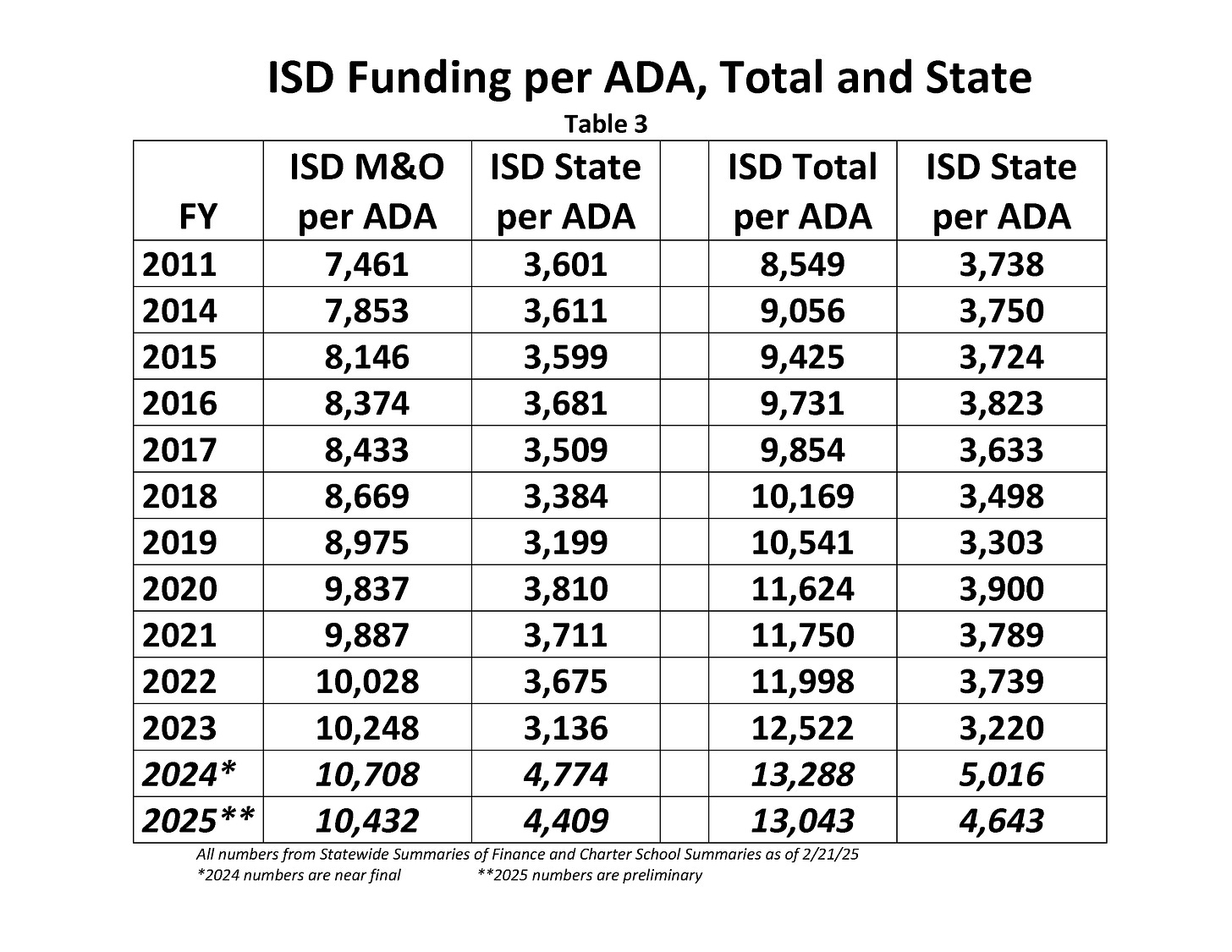

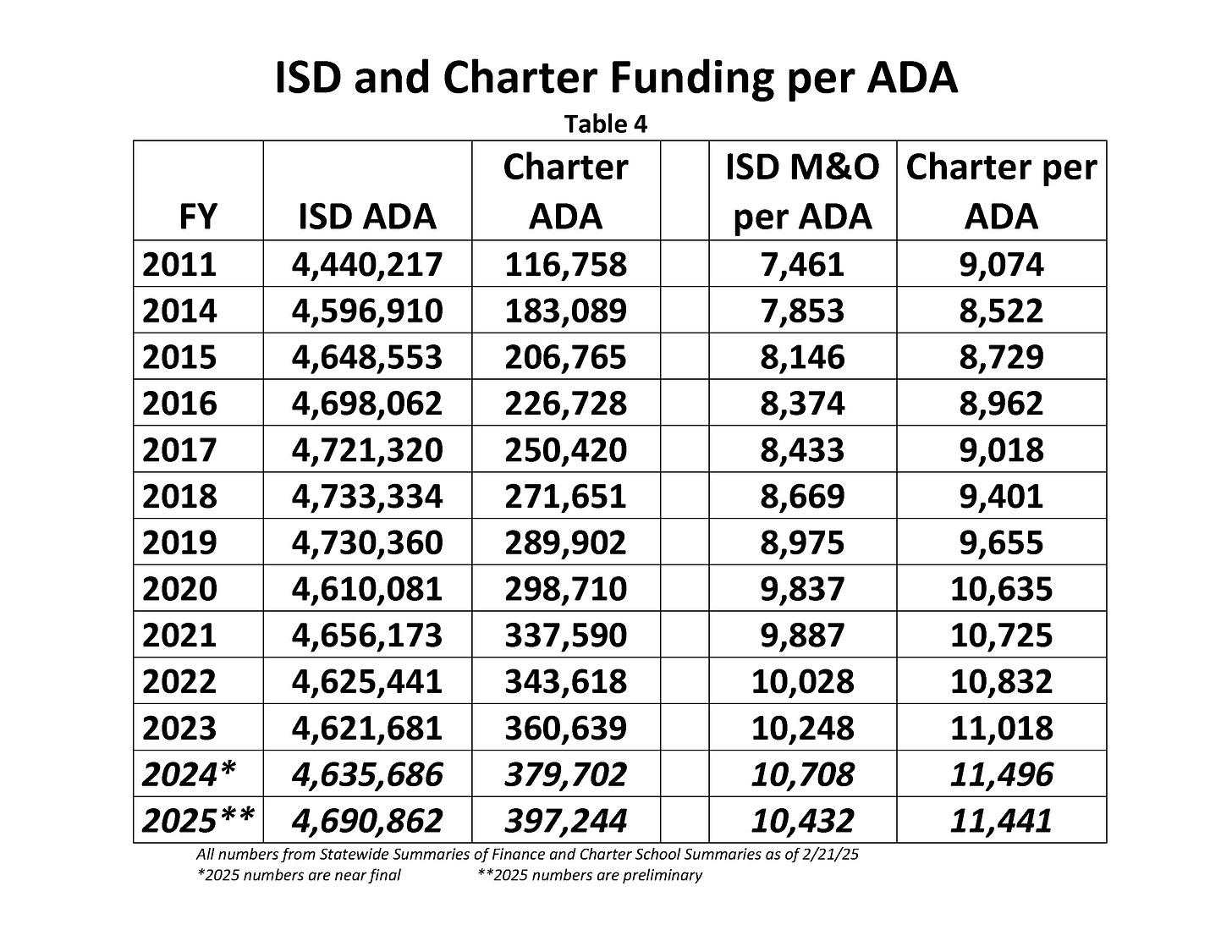

Well, it's even more true if you turn to table three, which does that on a per-student basis, you'll see how much that's even more the case. Okay. And the left-hand part of it is M&O. The right-hand is when you include I&S into it as well. So let's just look at the left-hand column for now. Table two talks about what the state has and hasn't done with respect to funding for bonds and facilities under INS. But if you look at the M&O column there, you'll see that the overall M&O revenue that school districts had to spend per student in 2011 was $7,461. In 2024 it went up to $10,708. It's about a 43.5% increase. But let's stop for a moment at 2023 because, again, 2024 is a special case and we've got another page where I'll talk you through that.

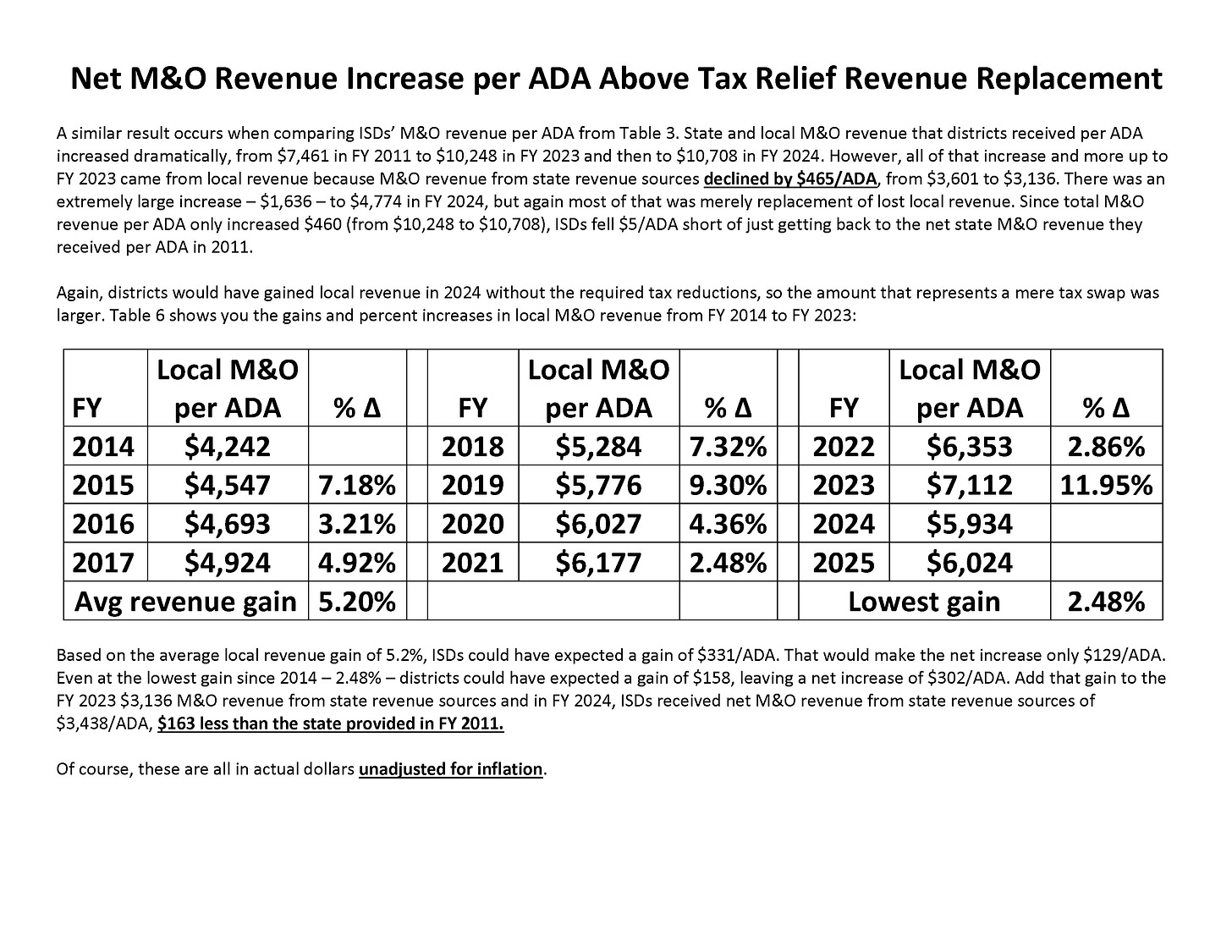

But if you take a look at it from 2011 to 2023, that was about a 34.5% increase. But you'll notice that the amount of money that came from state revenue sources, and again calculated the same way we did there where you basically said how much did the state give them? How much of that was not recaptured? How much of that didn't go to them? It went to the charter schools. What's left that the state gave to the school districts on a per student basis from 2011 to 2023 in actual unadjusted for inflation dollars? It went from $3,601 down to $3,136 per student. So you have a big jump from there to 2024, and if you want, I can talk to you about how much of that actually improved funding for schools versus how much of it just replaced lost revenue.

Rep. John Bryant:

Go ahead and talk about that.

Paul Colbert:

Okay. If you take a look at the increase from 2023 to 2024, in the state aid column it goes up by $1,638 a student, but the amount of money that districts actually had available to them from state and local sources went only from 10,248 to 10,708. That's a $460 increase. That means that essentially about three quarters of that big jump of money, that 1,600 plus dollars of money, about three quarters of that money didn't improve the funding for local school districts. It replaced the money that they lost because they had to lower their tax rates, and they had to lower the amount of taxes collected because of the Homestead Exemption increase.

If you turn to the last two pages, I talk to you through that a little bit more in terms of first the total dollars, and then the last page is the dollars per ADA. And that $460 per student that I was talking about there a moment ago, that assumes that the only decrease that was covered by the tax swap was from the year before. But property values rise every year. School districts adopt TREs, although not very many of them every year, so their tax rates go up. So there was additional money that would've been required to have been paid, just based on what the property values were. That was then reduced by the tax swap as well, so the actual amount of decrease was larger, and then that difference between 1,638 and 460. And these two tables, table five and table six, walk you through in total dollars and then in dollars per ADA, how much you could reasonably expect was the net amount of increase in revenue that the school districts got.

And in either of those circumstances, when you add that net revenue to where they were in 2023, they're still below where they were in total dollars, below where they were in 2015 and in dollars per student, below where they were in 2011.

Rep. John Bryant:

What do we have to do with the Basic Allotment to catch up?

Paul Colbert:

Well, you have to increase it, which you've heard an awful lot of, and I won't necessarily repeat the testimony with respect to that, other than to make a couple of points. Number one, the Senate's approach is we're just going to fund teachers and we'll also throw a little bit of money in there for the School Safety Allotment because that was an unfunded mandate. The problem that you run into is just over 50% of most school districts budget is their teachers, and districts have a very large number of other big ticket expenses. First of all, all of their other staff, and that staff is necessary.

When we went through our budget crisis in 1986 and 1987 while I was Budget Chair of Education, one of the things that we tried to do is we said, "Well, okay, you need to concentrate what you're doing on teachers and not have so much in the way of these aides and stuff like that." Well, the result was the next session we had teacher after teacher after teacher come in and say, "You have made it impossible for me to teach because now I have to spend all of my time doing all of the paperwork stuff, and doing all of the assistant stuff that those aides used to do for me." Which was an incredibly not smart use of our monies to have the much higher paid teacher doing that than having the aides doing it. And it took the teacher's time away from task.

So you got to provide money for the degree to which those costs have gone up since 2019 if you want to make sure that you're not once again putting burdens back onto teachers, because the first people they will lay off are all of those other people. And you've heard testimony on that today. So the Basic Allotment needs to go up.

Now, I've sat in y'all's chairs on this committee. I've sat on the Appropriations Committee as this committee's representative on the education budget, and I understand the limitations that you have to work with. At the start of every legislative session the leadership gets together and they carve out how much money in the budget approximately are we going to put into education, how much are we going to put into healthcare, et cetera, et cetera. And you're given a top line dollar amount that you can work with, and all you get to do is rearrange the deck shares. How much of it goes to higher education versus how much of it goes to pre-K through 12 education, and potentially next year, how much of it also goes to vouchers? But it's a fixed dollar amount that they're going to give you, okay. And so you've got to live within that, and that amount, even though we have enough money to be able to do it, the amount that they're giving you to do this time around I understand isn't enough to be able to do what needs to be done.

And Chairman Buckley, again, I applaud you for the degree to which you've tried to address these things.

My recommendation to you would be that you do a phase in to where you know the Basic Allotment needs to go.

Rep. John Bryant:

Thank you.

Chairman Buckley:

Representative Frank.

Rep. Frank:

Thank you, Chairman. Yeah, I wasn't incredulous as much as looking at the conditions you've placed on what you count as what revenue, because to my understanding, the conditions you place on it is we can't count it when we use state revenue to replace local property taxes, that doesn't count. It also doesn't count, you can't look at state monies used to pay for public school students in your school district if they are public charter school, and you can't look at recapture, et cetera. It's an impressive list of conditions to get you to the conclusion that you would like. And I think it is inconsistent with, to me, when we look at school funding doesn't matter which pocket that you take it out of, you look at the whole funding. That's a comment more than a question. Thank you.

Paul Colbert:

Well, but you are basically saying something that is not what I said. What I said was I am showing you what you are giving to your local school districts for them to run the program within their school districts. They don't get the money that goes to charter schools. They don't get the money that goes to the teacher retirement system. This is the money that the schools that are in your district receive in order to be able to run the programs that they offer. That's why those limitations are on there.

Rep. Frank:

This is nowhere close to the total funds used in your-

Paul Colbert:

I never said it was the total funds. I said this is the total funds-

Rep. Frank:

Right. But you're cherry-picking, but that's fine. That's what we do here. Thank you.

Paul Colbert:

No, I'm not cherry-picking. What I said was these are the funds. If you want to know what your school district has available to be able to spend on educating the students that they are obligated to serve, this is the amount of money you're giving them. And the reason why I subtract out the tax swaps is that does not increase the amount of money that's available to the districts to spend one penny, it merely replaces the revenue that they previously got from local revenue sources.

Chairman Buckley:

All right. Representative Schoolcraft.

Rep. Schoolcraft:

Mr. Colbert, I'm looking at table three.

Paul Colbert:

Okay.

Rep. Schoolcraft:

Just trying to understand. It says ISD funding per ADA total. It looks like you're saying, well, I don't know why there's two columns both marked ISD state per ADA? But say, looking at 2024 it's between $4,705 a student ISD state per ADA. Is that right?

Paul Colbert:

Well, first of all, let me explain again what the two columns, the two sides of the table were, and I mentioned it briefly, and I'm sorry if I wasn't clear with respect to that. The left-hand side is just the M&O funding. The right-hand side is if you include both M&O funding and the money that they get from local I&S taxes and from state aid, from IFA, EDA and ASAHE for paying for their facilities and bonded debt. So the second column is M&O plus that other money.

Rep. Schoolcraft:

That's okay. All right, so what is the annual appropriation under the public education?

Paul Colbert:

I'm sorry?

Rep. Schoolcraft:

How much do we appropriate for each year?

Paul Colbert:

I don't have those numbers in front of me, but again-

Rep. Schoolcraft:

I believe it's 93 billion?

Paul Colbert:

No, they wish. No. First of all, again, all I'm talking about here is not the total expenditures that the legislature makes, I'm talking about here the money that your school districts have to operate with. And they don't get to operate with the money that goes to the teacher retirement system. The traditional tax-supported ISDs don't get to operate with the money that doesn't go to them, but goes instead to charter schools.

Rep. Schoolcraft:

We could talk forever on this. That's good. Thank you.

Chairman Buckley:

Dr. Allen.

Dr. Allen:

Thank you. Mr. Colbert, I'm on table four, the difference between charters and state schools. What is the amount of the expenditure, and I want you to explain that chart to me, the amount of revenue going into charters as opposed to public schools. And I know they say charter schools are public schools, but you know what I mean. Okay, so would you tell me what that looks like?

Paul Colbert:

Sure. Okay, so table four first of all gives you the number of students who are involved in the traditional property tax-supported ISDs, and then the second column gives you the number of charter school ADAs. So you can see that while school district ADA has been relatively flat over that period of time, the charter school ADA has more than tripled going back to 2011. If you take those ADA and you divide them into that right-hand column from table one, I'm sorry, it's not the right-hand column. It's the combination of the right-hand column and the local revenue column from table one, you get that M&O per ADA. That's how much money from state and local resources the traditional school districts have to spend within their programs per student. That's what that column is.

Charter schools are funded 100% by the state. So all this is the state M&O revenue from the Statewide Charter School Summary divided by the number of charter school ADA. And as you can see, traditionally charter schools have been funded higher than traditional ISDs on a per-student basis virtually every year. The explanation frequently has been given that's because they have to get it in their M&O money because they don't have facility money, although they now are getting $60 million in facility money each year. And then I believe in House Bill 2 you have a number of provisions that would dramatically expand the amount of facilities money that would go to charter schools.

But the basic reason for that difference is that traditional ISDs only get funding from the small and mid-sized adjustments if they are small or mid-sized. Charter schools don't get the funding that would be based on their actual size. They get the combined statewide impact of the small and mid-sized average impact on schools throughout the state. Plus it might also have the impact of a little thing that's called the Sparsity Allotment too. I can't remember if that's included in there. But basically, whether they're small or they're large, and some of the charter schools are much larger than many of our ISDs, they nonetheless get the statewide average impact of the small and mid-sized, and possibly the Sparsity Allotment, and that's why they end up showing up with a whole lot more money for M&O purposes per ADA.

Dr. Allen:

Okay. So if I wanted to sum that up, could I say that charter schools get more funding than the ISDs?

Paul Colbert:

For M&O purposes, yes. On average they definitely do.

Dr. Allen:

Thank you.

Paul Colbert:

They will get less than an actual small district would get because the small adjustment could take them up as much as 64%. Under the current formula none of them go all the way to 64%, but they can be 40, 50, 60% more funding, and that would definitely get them up above. I mean, that's why the average is 10,432 in part, it's because some of those districts are at 14, 15, $16,000 a student.

I might add the other thing is that the statewide average funding includes special education funding. And in general, the concentration of special ed kids in charter schools tends to be a lot smaller. Therefore, the gap is actually a little bit bigger in terms of the operational costs because the ISDs are spending it on special ed students that the charter schools may or may not have as many of.

Dr. Allen:

Thank you.

Chairman Buckley:

Is there a hand up?

Paul Colbert:

I had seen a hand over here before.

Chairman Buckley:

Yeah. Representative Hinojosa.

Rep. Hinojosa:

Appreciate you breaking up these numbers in different ways to see what's included, what's not, for transparency purposes, because it's often hard to discern what's included in numbers that we talk about here. The page that has struck me is the page on I&S funding, funding for facilities, the second page.

Paul Colbert:

Yeah.

Rep. Hinojosa:

Okay. The way I read this is we've cut facilities funding, I guess, for school districts from the state by almost a fifth since 2011.

Paul Colbert:

It's actually worse than that if you go back farther. There are three sources of funding for facilities and bonded debt funding. One of them is called the Instructional Facilities Allotment, which was created in 1997, and then the EDAs, the Existing Debt Allotment created two years later, in 1999. Subsequently, when we started doing the Homestead Exemptions we created the Additional State Aid for Homestead Exemption, which is politely referred to as ASAHE, and that's the second column that's over there. When we started out funding facilities in 1999 that was basically then Governor Bush's tax relief program. It was what he literally used to campaign successfully for president on, because of the amount of tax relief that was provided through the creation of the EDA and through the increase in the yield and the Instructional Facilities Allotment from $28 a student to $35 a student.

They basically remained at that level since 1999. And there's a slight increase that's been given to the EDA side of it, but it never has topped $40. What that means, a $35 yield is the same thing as saying a district with a wealth of 300... I'm sorry, my mouth is starting to dry up here. $350,000 per unweighted ADA. When we created that program in 1999 over 90% of the students in the State of Texas were in districts that qualified for that funding, and that funding that year paid for one-third of all bonded debt costs.

Rep. Hinojosa:

Wow.

Paul Colbert:

We haven't changed that 35 bucks other than the slight increase for the EDA, aside from the fact that costs for construction and costs for land and everything else have gone up dramatically in that 25 year span of time. In addition to that the wealth of school districts has grown, and as the wealth of school districts has grown, their local taxable wealth per ADA has grown. One of two things happens. Either they totally price out, they get to be above 350,000 when they were below it before, and therefore they no longer qualify for IFA or EDA funding. Or even the ones who still qualify, and it's a depressingly small number of districts these days, even those districts, as they get closer to the $35 yield with what they can raise locally, the amount of state aid that they get goes down. So that's why those numbers shrank.

The result was we went from that 33% of total funding in 1999 down to this past year 1.2% of total funding came from the IFA and EDA. Now, when we created ASAHE, that's a general goes to every district, rich or poor, based just on their losses from the Homestead Exemption, and that amount of money has increased dramatically. So we're picking up about 8% of facilities costs now. That goes to rich and poor districts alike. So the money we're giving to the poor districts is the side that has shrunk dramatically. At its peak it was over $770 million. So at its peak it was about six times the size of the amount we're putting in now.

Rep. Hinojosa:

Okay.

Paul Colbert:

And by the way, that's tax relief. That's what Governor Bush campaigned successfully for President on is tax relief. So if you're going to put money into tax relief this is a twofer at the very least. Because number one, you're providing real tax relief, and number two, you're helping your schools and your property taxpayers at the same time.

Rep. Hinojosa:

So I thought you were going to say if you want to run for higher office, you should increase the amount of INS funding that you spend by up to 30%.

Paul Colbert:

I wasn't going to say that, but if anyone was planning on running for higher office or maybe even the office that Governor Bush ran for, that would be a smart way to do it.

Chairman Buckley:

Nobody here is running for President. Let's keep it on HB 2.

Rep. Hinojosa:

Let me ask this-

Chairman Buckley:

At least not that I know of.

Rep. Frank:

I'm running for the county line when this is over, Mr. Chairman.

Rep. Hinojosa:

Were you in the legislature when you created funding for charter schools?

Paul Colbert:

No, I was not. That was 1995, and that was a couple of years after I left the legislature.

Rep. Hinojosa:

Thank you.

Paul Colbert:

Two sessions after I left.

Rep. Hinojosa:

Thank you.

Chairman Buckley:

Representative Leo-Wilson.

Rep. Leo-Wilson:

Thank you, Mr. Chairman. I'm going to stick on that chart, but I have two questions. On that last column where you were mentioning the IAFA plus the EDA, is that federal?

Paul Colbert:

No. This is all state programs. The federal government doesn't give us a penny for our local districts for those purposes.

Rep. Leo-Wilson:

Okay. And then I don't know if this has also a factor into it, but we saw a chart yesterday from TEA where they described the different district types. I guess it wasn't yesterday, it was Tuesday. In all of the district types the charter school group was the group that had the very highest teacher to student ratio. So they have... I don't know if that factors in that table 4.

Paul Colbert:

Not on the facilities chart.

Rep. Leo-Wilson:

On table 4?

Paul Colbert:

Oh, on table four. Again, what this shows you is the amount of revenue from, in the case of ISD, state and local resources they had. Or in the case of charter schools only from state sources because they don't have local tax sources. This is the amount of revenue that they had on average available to spend per student. How they spent that was up to them. So some of them might've spent it on teacher salaries being at a higher level, some of them might've spent it on having smaller class sizes, meaning hiring more teachers. Some of them might have spent it on other necessary expenses. As I said, almost half of their budget isn't even on teachers. It's on paying their utility bills. It's on paying their representative. Hunter's not here. I was going to say insurance costs, which I know is of a particularly big concern to him. It's on paying for their school buses. It's on paying for the gas for those buses. It's on paying for, et cetera.

Rep. Leo-Wilson:

Okay. Thank you. Got it.